Gravy, a subscription-based revenue recovery firm, recently acquired $4.5 million in Series A funding — the first stage of venture capital financing — from Arlington Family Partners. The company’s focus is to provide human-first technology to reduce the complication of involuntary church. The funds will be used toward growing that focus by expanding Gravy’s brand and client acquisition.

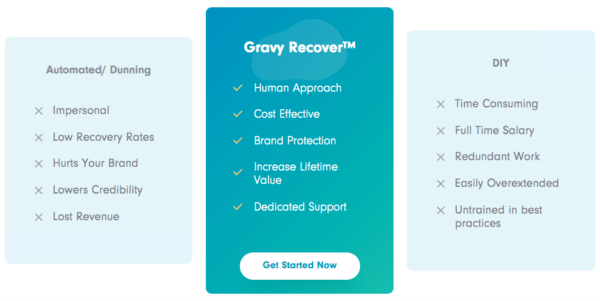

Involuntary churn, or the unintentional cancellation of a subscription service due to failed payment, is an issue in the subscription industry that causes companies to lose 9% of their monthly recurring revenue (MRR). Normally, when a subscriber falls victim to involuntary churn, they receive an automated message attempting to rectify the issue. Gravy’s overarching strategy is to offer its clients human interaction with their subscribers in order to retain customers.

To utilize Gravy’s services, a subscription business has to sync its payment systems with Gravy’s software, after which a recovery team will be assigned to it. Both parties will then discuss the company’s brand, its goals and other details needed by the recovery team to do its job. Finally, the dedicated team will start recovering failed payments. This entire process is crafted on a subscription basis between Gravy and its customers.

New Funding Leads to Expansion?

CEO Casey Graham obtained these funds through the lifelong relationship he has built with Arlington Family Partners, a family-owned business located in Birmingham, AL. Ken Polk, the company’s CEO, is one of Gravy’s board members.

The $4.5 million investment shows the faith Polk has in his friend’s company. “[Arlington Family Partners] have seen the growth and they’re hyper conservative people,” Graham told SUBTA. “I remember after they saw our growth, they came out of the woodworks and said, ‘Hey, if you’re going to do any money raising, please do it with us.’ It shocked me.”

The company is making its way toward $1 million of MRR in the early stages of Q3 this year. As its customer base grows, Gravy’s team must do the same. The company plans to use the funds to expand its client-acquisition efforts. One way Graham plans to do this is by investing in the company’s brand. “We’ve become one of the largest companies in the world on LinkedIn with LinkedIn influence. So what would it look like if we gassed marketing, right?”

Gravy’s plans for client acquisition also involve building integrations. “Think of the Shopifys of the world, think of the Stripes of the world, think of all the subscription managers of the world, and you think of all of these different things. We plug in and use all of them,” says Graham.

The Focus on Human Connection in Subscription

Most subscription businesses rely on automated messages alerting customers about a failed payment. However, an automated message only brings 15% to 20% of the customers back, according to Graham.

“What we found is just leaving your subscriptions up to a piece of software to take care of it is a lazy way to do this,” he says. “We work on top of those with our human approach to it.”

His solution for involuntary churn was to apply leadership and have one person focus on returning failed credit card payments and subscriptions back to the company. Graham calls this a metric-based leadership. However, not all subscription businesses have the luxury to hire a full-time employee monitoring the back door. Gravy’s one mission is to keep that door shut. “We work with [these companies’] customers. Those customers have no idea Gravy exists. We have what’s called brand integrity, where we act, respond, connect, and work as if we are our clients via email, via their brand standards, via their culture.”

Gravy created an entirely new experience for subscribers. The subscription industry values community and personable engagements. Subscribers are more likely to respond to an actual person rather than an automated email or text message, as it’s easier to dismiss such outreach. Gravy is optimizing this opportunity for growth in customer retention for its clients. “You’re not just winning back a payment. This is about people and there’s a person behind every payment. That’s how we win people back, we use empathy,” says Graham.

Gravy’s implementation of a human-to-human model showed an increase in the revenue-recovery rate from 15% to 80% since the company was founded in 2017. Its strategy to build trust through human interaction could return $1 billion in failed payments to its clients. At least, that is Graham’s goal for Gravy within the next two years.

Key Takeaways:

- Gravy acquired $4.5 million in venture capital financing.

- Automated messages only retain 15% to 20% of subscribers, according to Casey Graham, Gravy’s CEO.

- Gravy expects $1 billion in failed payments returned to subscribers by 2023 with the support of its new funding and current growth strategy.