Stripe is now worth $95 billion, making it the highest-valued U.S. startup — ahead of SpaceX and Instacart. While the company has helped e-commerce businesses process online billing for over a decade, its recent financial software expansion allows merchants to adopt subscription payment structures and manage recurring revenue streams. Now, the San Francisco/Dublin-based company is looking to leverage its valuation to tap into new e-commerce markets.

Last Sunday, the company raised $600 million in Series H (8th round) funding, with large investments coming from Allianz Insurance and Ireland’s National Treasury Management Agency (NTMA). Stripe will use this money to support global expansion, increase customer service, and improve software infrastructure.

As subscription businesses embrace online payments, the company aims to become the go-to-payment-processing tool for the subscription industry.

Stripe’s Role Within the Subscription Space

Stripe is a big competitor in the financial service market. In Q3 2020, Forrester Wave praised the company as a leader in payment providers. Over 146,000 domains — ranging from startups to large companies like Shopify, Instacart and Zoom — use Stripe.

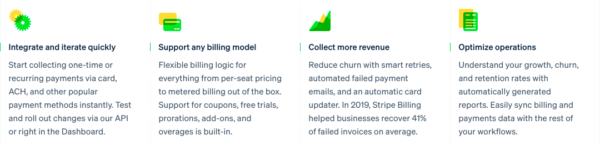

With Stripe, merchants can adopt subscription payment structures and bypass the tediousness that comes with online transactions. Its software allows users to collect recurring payments, implement coupons and trials, and track growth and retention.

Photo Credit: Stripe.com

Among Stripe’s many offerings is an email feature that can minimize involuntary churn. Businesses that use this tool can expect to recover 41% of failed recurring payments on average.

The company is still not at the top of the payment software industry, however. With only 20% of the market shares, Stripe trails behind PayPal, which owns more than 54% of the market shares.

Stripe’s Expansion into the European E-Commerce Market

Stripe intends on establishing a stronger presence in the European market where a majority of its business takes place, according to a newsletter released last weekend. This expansion is monumental, as Stripe spent 2020 developing its platform to accept new forms of international payments. The push toward this market will gain revenue streams from untapped sources like Bacs Direct Debit in the U.K.

“The growth opportunity for the European digital economy is immense,” states President and Co-Founder John Collison. The decision to expand into Europe can be linked to the recent hypergrowth of Europe-based subscription companies like Deliveroo, Glofox, and Doctolib.

Stripe will begin by improving its operations in Ireland. Its partnership with the country’s National Treasury Management Agency gives Stripe more credibility within the region, as NTMA supports economic activity and employment in the state. “[NTMA] is convinced that, despite making great progress over the last 10 years, most of Stripe’s success is yet to come,” says NTMA CEO Conor O’Kelly.

Stripe’s expansion in Ireland will also create approximately 1,000 new local jobs, which will help many families recover from the coronavirus pandemic’s devastating economic impact over the last year.

Investing in Long-Term Infrastructure

The European expansion will be matched with operation investments that can benefit online merchants for years to come. “We’re investing in the infrastructure that will power internet commerce in 2030 and beyond,” said Dhivya Suryadevara, Stripe’s Chief Financial Officer.

The customer service support team will be extended to allow the company to meet its larger clients’ demands while also giving startups the attention they need.

Stripe also plans to modernize its suite of software services to enable efficient management of subscription transactions. By continuing to diversify its billing software, Stripe can make payment processing more user friendly for its customers.

The global payment processing market is projected to reach $120.7 billion by 2025 with a growth rate of 10.2% per year. Stripe is looking to stay ahead of the curve by reinvesting in assets crucial to its success. “[Stripe] raised a new round of financing to help support our international expansion and efforts to enable the global startup ecosystem,” CEO and Co-founder Patrick Collison announced on Twitter.

Stripe managed to become the highest-valued startup while remaining private, but how much longer will it stay that way? Investors speculate the subscription payment company could be the biggest IPO in 2021 if it chooses to go public.

Key Takeaways:

- Coming off $600M in Series H funding, Stripe’s $95B valuation makes it the most valuable startup in the world.

- The company plans to grow in the European e-commerce market, extend its customer service support team, and modernize its software service offerings.

- The global payment processing market is expected to grow by 10.2% every year until 2025.