1: Introduction to the M&A Process

There is no cookie-cutter approach or set timeline for the M and A process. Rather there is a set of processes that most transactions follow to optimize the outcome for the seller. This guide will outline the steps of going from initiation of a transaction to closing it, keeping in mind, mergers and acquisitions are not formulaic and contain a significant artistic element. The steps outline a common process in the broadest terms only, and the timeline and components in this paper are an indication of what to expect rather than a set of rules.

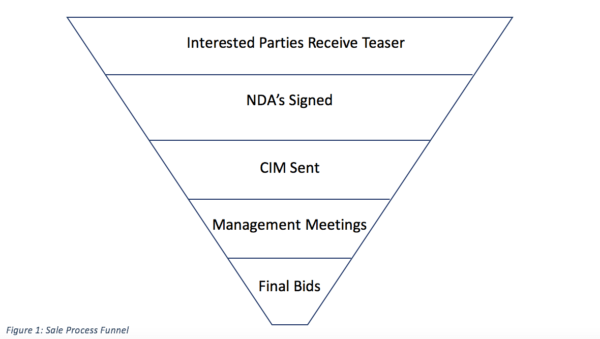

Think about the process as a funnel. One starts with a potentially large number of candidates, but as information is disclosed and details are discussed, this group will be whittled down. Each step of the process is designed to remove a number of parties who, for any of a number of reasons, are not suitable as buyers. Ultimately it yields one buyer who has a full understanding of the opportunity and is prepared to buy the business on terms and conditions that are acceptable to the seller.

Prior to going to market with a company it is important to have a realistic set of expectations. Once the decision has been made to sell all or part of the business, the first step is to retain an advisor. As good as you may be in building your own business, chances are you have not sold companies regularly, or have in fact ever done it before. Even the most active private equity firms use advisors because the process is specialized and there is no substitute for doing it on a daily basis. You will also find that different advisors have different perspectives and ideas, so interview at least two or three, listen to them carefully during the interview and glean as much knowledge as possible.

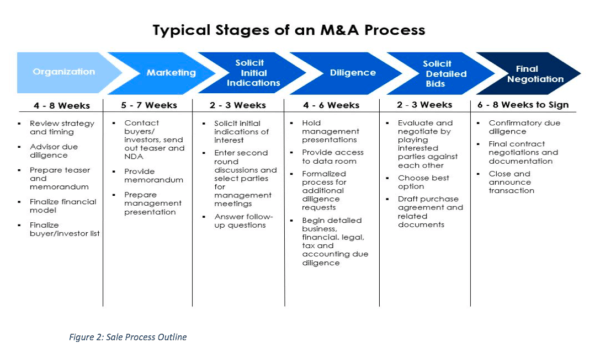

2: Stages of the M&A Process

2.1: Organization

The first stage of the process is preparing information about the business. Generally, the time required to do this is underestimated by the owners because a company does not keep its information in the form required for conducting a sale. They may know a lot about the business, but all that knowledge has to be put in a form that allows a prospective investor to see the company completely, but also in the best light.

From the data gathering and due diligence that the advisor does, three deliverables should be prepared:

- A financial model that presents both the recent history of the company, as well as management’s best estimate of what the future holds.

- The confidential information memorandum which paints a complete picture of each of the significant components like marketing, legal, finance, competition, market size etc. as well as an overview of the company as a whole. The Confidential Information Memorandum’s (CIM) goal is to tell the company’s story, exciting potential investors/buyers about historical successes and future growth opportunities.

- A teaser, which is sent out to potential investors once they have confirmed that they have an interest in very broad terms. The purpose of the teaser is to whet a potential buyer’s appetite for the investment and induce them to dig further into the opportunity.

2.1.1: Sales Strategy Preparation and Buyer List Development

The second component of the organizational process is the development and review of a sales strategy . The strategy is tailored for each client individually, by the advisor working together with the principals and is guided by the ambitions of the sellers, the stage of their business and whether the marketing should be aimed at financial or strategic buyers or both. Understanding the clients’ objectives enables the team to set a course that will achieve the goals as closely as possible. It is probably impossible to achieve everything that the owners want in a single transaction, but one of the investment banker’s key roles is to manage the anxiety and stress that this process creates while attaining as many of the goals as possible.

The primary product of the strategy development is the preparation of a list of potential buyers and investors. Because of the sensitive nature of the process, there is often a goal of not letting suppliers, customers, employees and other parties who are members of the immediate constituency know. This is for a variety of reasons and is often the individual choice of the owner, with no impact on the sale process Additionally the owners may not want to approach competitors because of a fear of revealing sensitive information. While the use of the data can be managed, these considerations often impact the preparation of the buyer list.

2.2: Marketing

The second phase is the commencement of the selling process. After finalizing the materials, the advisor will begin its outreach to the vetted names referred to on the list above. Depending on the size and composition of the list, this phase of the process typically takes four to eight weeks because invariably a number of the people on the list will be preoccupied, travelling, not focused or some other reason for not responding promptly. Understand that while the sale may be the most important thing to the seller at the time, it is only one of a number of things being dealt with by a potential buyer and is not always initially given the highest priority.

Managing this process and telling the company’s story effectively is part of the art of the advisor’s trade. They identify what will attract each investor and make sure to highlight these points in the initial call. If successful, the teaser and the non-disclosure agreement to be used will be sent out to the potential buyer. Once the agreement is signed the full memorandum will be sent out.

The memorandum will contain more detailed information including financial and operational metrics and the advisors may also send the financial model. All this information will help prospective buyers determine both the strategic attractiveness and the financial value the Company. This phase of the process is time-consuming and moves only as fast as the interested buyers do. Balancing the need for buyers to move quickly against achieving the optimal structure and value is an art, and the goal is to keep the buyers engaged and competitive.

3: Request for Bids

Once all the potentially interested parties have the material and have been given a chance to digest it, the advisor tries to receive all Initial Indications of Interest (IOIs) at the same time. An IOI will typically contain a brief description of the buyer including its history , experience in doing this type of transaction, management experience and financial resources, an outline of the price and structure proposed for the investment, any significant conditions to moving forward, and a number of logistical and legal issues to be dealt with. The purpose of managing the timing in this way is to create a competitive dynamic that will result in the best proposals coming in simultaneously By doing this they can be compared and narrowed down. In a broad auction it is not unusual to get six or more meaningful indications, and these need to be compared and evaluated for price, terms and probability of closing. Another critical component at this juncture is an initial analysis and comparison of the buyers.

4: Management Meetings and Due Diligence

After IOIs are received and interested parties vetted, and the most compelling group of buyers has been narrowed to a small handful, they are invited to meet with the management team. These meetings typically all take place over a short time frame and enable the buyers to meet management face to face, ask questions and learn more about the company and opportunity. They also give the management team an opportunity to show more detail about the company and discuss strategy and plans for going forward. These meetings are typically highly interactive, providing a lot of discussion and deeper investigation of elements that were not fully discussed in the memorandum.

This exercise does not solely benefit the buyers, it gives the sellers a chance to learn more about each buyer and begin to formulate who might be the best partner to take the Company to the next stage in its evolution. The sellers need to determine who they will be able to work with going forward and which buyers have a set of values and way of doing business that coincide with those of the sellers. Often deals are struck and end up with a suboptimal outcome because of disagreements that surface post-closing. This is the time to really understand the nature of the buyers so that a well-informed decision can be made.

At the same time that these meetings are being arranged and conducted, the buyers are often given access to additional, more detailed information about the company. This is generally done by establishing an electronic data room which allows select people access to the material and ensures that all buyers receive the same information. The data room is typically set up by the advisors working with the company lawyers and accountants and is designed to provide a lot of detailed information to the buyers to enable them to evaluate both the opportunities and risks in the business.

5: Solicit Final Bids

Following the management meetings, the bidders that remain interested are asked to submit final proposals. In a letter to the finalists ( called a process letter) the advisor will lay out the requirements for the final proposal including important dates, conditions, financing source confirmations, etc. The buyers in each of their responses lay out the financial terms of the proposed transaction, but also include any significant conditions to closing, including any major legal issues that have come up in the course of the evaluation and meetings. Prior to countersigning the winning letter, the seller has leverage and the advisor negotiates the best possible transaction, often by playing off one bidder against another. The advisors and sellers then compare these final proposals and reach a conclusion about which one to pursue.

6: The Final Negotiation

After signing an LOI the buyer and seller together with their respective advisors and attorneys work to document the purchase agreement. While the LOI will have laid out the important elements of the agreement so that no further negotiation is necessary on deal-breaking items, it is not a legally binding document in most respects. The purchase agreement encompasses the detailed terms of the negotiation. . It is typically long and encompasses a number of ancillary documents which are necessary for a closing. Drafting is a time-consuming process because the documents have to cover all of the details and take all of the uncertainty out of how to resolve any issues. In addition, there are many items that would not have risen to the point of being addressed in the LOI, but need to be resolved. The contents of these documents are outside the scope of this paper, but it is important that a seller has legal counsel that is experienced and proficient in this type of transaction to ensure that sticking points are dealt with efficiently and appropriately.

At a high-level, the process appears streamlined and scientific. However, the outline above simplifies and abbreviates the amount of work and time that go into a sales process. The work done and its nature is unique to every deal situation, and often information that buyers would like is not available in the required form or at all. The work is nitpickingly detailed which ultimately ensures that there are no surprises for seller or buyer. All-in, this process typically takes nine to twelve months and is tailored to client’s specific needs. The paper should give an outline or expectations, but ultimately a seller should start the journey by speaking to someone who is experienced and who has demonstrated good judgement in the past.

—

Written by Errol Glasser

Partner, Triangle Capital

https://trianglecapitalllc.com/