Google’s recent acquisition of Fitbit pushed the company to become a leader in health data storage, alongside Peloton and Apple Watch. However, the $2.1 billion deal is sparking controversy among those who fear Google might use Fitbit users’ data for the wrong reasons.

Google finalized the Fitbit deal in January 2021 following an antitrust approval that forbade the conglomerate to use Fitbit consumer data for targeted advertising.

The company released a statement afterward vowing to protect the 29+ million Fitbit users’ privacy in this regard. This vow disables Google from generating targeted ad revenue, but the company is already investigating other avenues to increase profits from the acquisition.

Google sent a survey to Fitbit users which hinted at a cheaper subscription model in the works. Ultimately, the conglomerate hopes to convert Fitbit’s free plan users into paid subscribers.

Controversy Over Google’s Data Reputation

Many fear that Google’s ownership of Fitbit will jeopardize users’ confidential health information. This is in accordance with a distrust for many big tech companies maintaining the integrity of democracy and honoring the right to user privacy. Google and Facebook have built an empire of user data that is accessible and malleable. With its acquisition of Fitbit, Google now has access to and control over 29+ million users’ health data.

In an attempt to cut out data malpractice, the European Commission (EC) set forth several commitments Google must honor with its ownership of Fitbit. EC’s executive Vice President, Margrethe Vestager, stated these commitments would “determine how Google can use the data collected for ad purposes and how users can continue to share health and fitness data if they choose to.”

Google immediately pledged to honor the regulations imposed upon it. “[Google] worked with global regulators on an approach which safeguards consumers’ privacy expectations,” the company’s Senior Vice President of Devices and Services, Rick Osterloh, said, “including a series of binding commitments that confirm Fitbit users’ health and wellness data won’t be used for Google ads and this data will be separated from other Google ads data.”

Through honoring Fitbit users’ privacy, Google is now legally closed off to ad revenue that could potentially come from this acquisition. The company is now potentially turning to a new subscription model to find alternative revenue streams.

A New Subscription Model Opens Up Revenue Streams But Leaves Room for User Concern

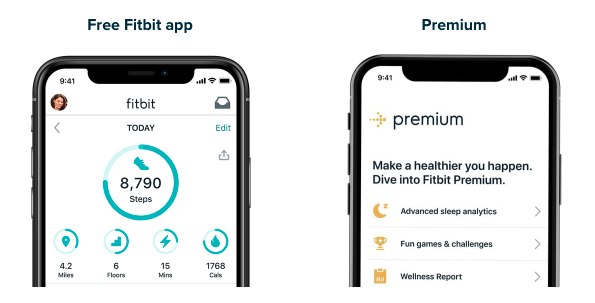

Fitbit currently offers a free and premium ($9.99/month) subscription option to its users. Google is looking to add another subscription tier to this model.

The company’s recent survey hints at a new premium option of $2.99/month— a cheaper alternative to the $9.99/month option in place. This initiative can enable Google to gain new subscribers who find the cheaper options more appealing for their current wants and needs.

At face value, this is beneficial for Fitbit customers looking to join premium at a lower cost. However, this may place subscribers at a disadvantage. Currently, the free plan allows users to access basic health metrics. Going premium ($9.99/month) opens up access to advanced metrics, guided workouts and extensive challenges. Google’s decision to create a second subscription tier ($2.99/month) to Fitbit could potentially devalue the free plan in place.

Publications speculate that Google could be moving some “free” features behind the $2.99 paywall. In other words, Google may choose to monetize numerous features that used to be complimentary under the free model. Tech publication, Techradar, suggests that “this would potentially make Fitbit products less useful for those who don’t wish to pay for its premium membership service.”

A Questionable Future for Fitbit

Google’s acquisition of Fitbit will create an unpredictable future for the fitness tracking company. Through its large $2.1 billion acquisition, Google hopes to leverage Fitbit’s potential to rise as a premier fitness tracking company. While the data conglomerate continues to update Fitbit hardware frequently, the state of Fitbit’s software services continues to have many unanswered questions. And, as antitrust regulations continue to monitor how big tech companies use data, businesses must adapt and think of new ways to generate revenue.

Key Takeaways:

- Following a $2.1 billion acquisition of Fitbit, Google is restricted from using the app’s fitness data for targeted advertising.

- Google sent a survey to Fitbit users that hinted at a cheaper subscription model in the works.

- While the proposed model provides a cheaper premium option for Fitbit users at $2.99/month, this can have potential drawbacks for customers.